Residential and commercial lending are not created equal for many reasons. Commercial lenders will often take a much lower risk then residential lenders are willing to take. Below we discuss some of the major differences to expect between commercial and residential lending.

Commercial

Income Qualification: In order to qualify for a commercial loan the lender is going to mostly take into account how much income your company generates versus the cost of the property.

Down Payment: Commercial loans typically require a much larger down payment than residential loans require. This is mostly because the commercial real estate market is much riskier so most commercial lenders will require at least 20% down.

Length of Loan: Again because commercial loans typically involve a much higher risk, the length of commercial loans are typically significantly shorter than those of residential loans. Most commercial loans will need to be paid within ten years.

Residential

Income Qualification: When applying for a residential loan lenders will mostly only take into consideration an individual’s income versus their current outstanding debts.

Down Payment: Those with good credit scores can typically negotiate a lower down payment on a residential loan. Lower down payments are often offered as long as a private mortgage insurance is also paid.

Length of Loan: Typical conventional residential home loans will have a 30 year term. Sometimes these loans can allow for a length negotiation depending on the borrowers financial standing.

Final Thoughts

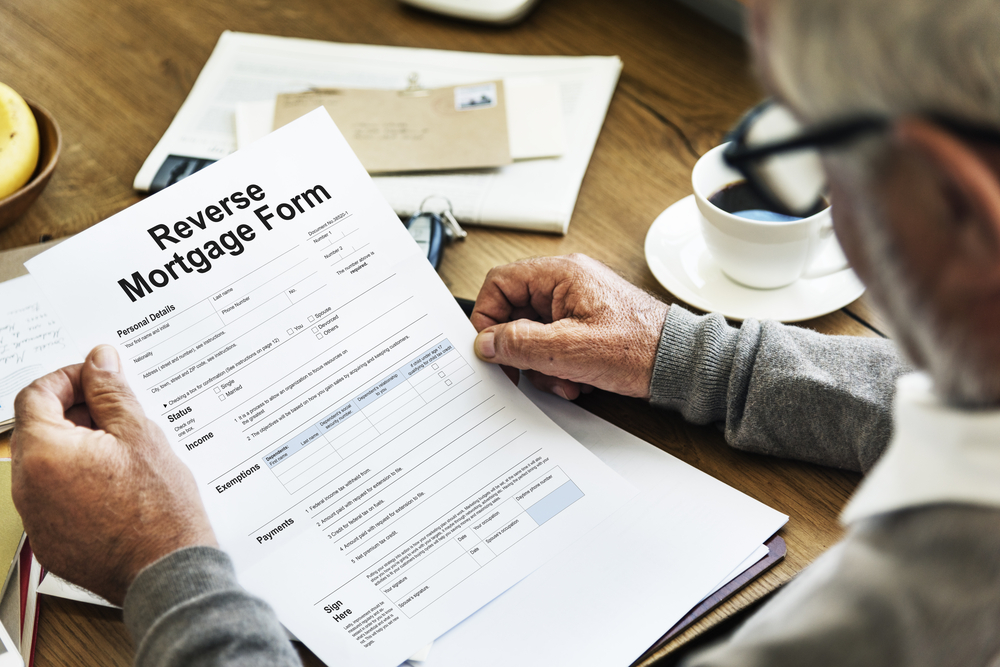

After a while, commercial and residential property owners will have options when it comes to refinancing their current loans. Refinancing can not only help reduce monthly payments and interest rates, but make it possible to reinvest into your property too. Call American Mortgage Resource, Inc. to learn more about our quick and easy refinancing options.