Are you in the process of buying a new home? When you’re talking to real estate agents and lenders, they are probably using terms in conversation that you have never heard before. You may hear terms such as “closing costs” and “escrow”, which is why it’s important to know some basic mortgage vocabulary so you don’t have to ask too many questions. In addition, purchasing a home is a big commitment, so you want to understand exactly what’s going on. In this blog, we discuss five mortgage terms you should know!

AMORTIZATION

When you are making equal payments towards the principal and interest, this is called amortization. You are essentially paying towards the interest in the beginning of your payments, but as the loan gets smaller, less interest is charged. It’s a gradual reduction of paying your debt over time.

CLOSING COSTS

The money you need to close the mortgage deal is called closing costs. These costs include everything from title insurance and escrow fees to lender charges and transfer taxes. FYI: All closing costs will be listed on the loan estimate that the mortgage lender gives you within three business days of your application.

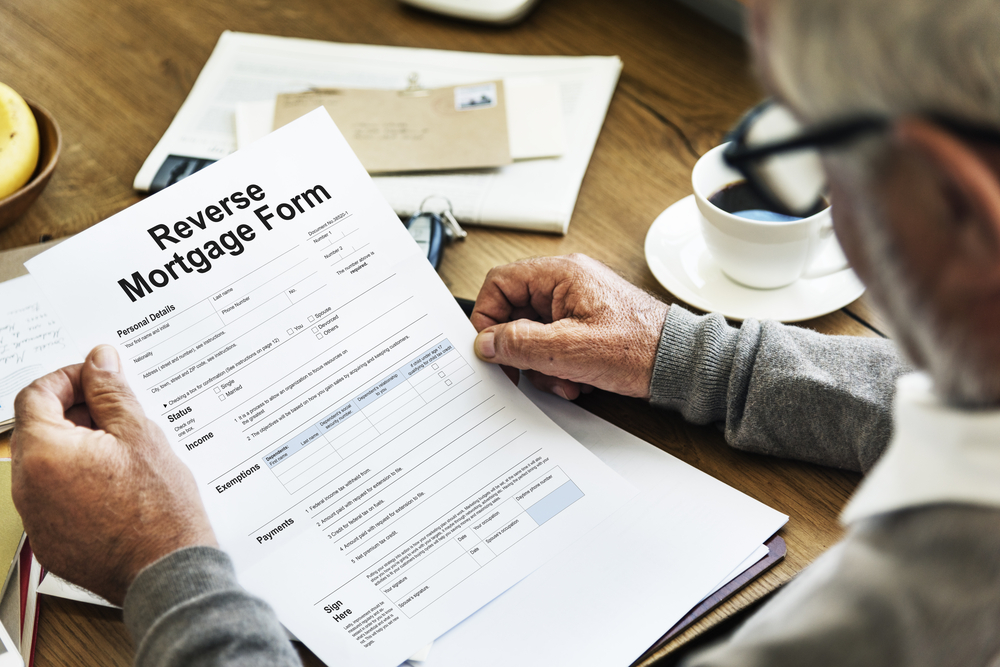

EQUITY

Equity is the difference between what you owe on your home and the current market value. As you pay your mortgage, the equity grows. You can tap into this value over time. For example, you can apply for a home equity loan, a home equity line of credit or a reverse mortgage.

ESCROW

“Escrow is a legal arrangement in which a third party temporarily holds large sums money or property until a particular condition has been met.” In real estate, escrow is used to protect the buyer’s deposit so the money goes to the right party according to the conditions of the sale. It also holds a homeowner’s funds for taxes and insurance.

TITLE INSURANCE

Title insurance guards against any disputes about the title, such as contractor liens or tax. It is a way for lenders and owners to protect themselves from financial loss and other related legal expenses.

Conclusion

At American Mortgage Resource, Inc., we are here to guide you through important financial decisions when it comes to buying a home. Let us help you with the home mortgage process and contact our team of professionals. Call us at 1-617-972-8588 or send us a message online!